High-deductible health plans have become common since the Affordable Care Act started in 2010.

About 30% of U.S. workers with employer insurance have plans with deductibles of $1,400 or more for individuals and $2,800 or more for families.

Deductibles have gone up by 61% for single coverage, and employer-sponsored premiums have risen by 43% over ten years.

These higher costs mean patients have to pay more money themselves.

Many patients now face large costs before insurance starts paying.

These costs include copayments, coinsurance, and deductibles.

The average out-of-pocket costs are expected to rise about 5% every year.

Because of these costs, 38% of Americans delayed or avoided care in 2022, according to a Gallup poll.

For low-income patients or those with long-term health problems, this can mean skipping needed treatments or medicines.

This often leads to worse health and more hospital visits that could have been avoided.

Because patients owe more money, medical offices find it hard to collect payments.

Usually, practices collect less than 60% of patient payments, which make up about 30% of total provider income.

This causes more bad debt and puts money pressure on healthcare providers.

Why Patient Collections Remain a Challenge

Old payment systems were made mainly to get money from insurance, not patients.

This causes trouble when bills are sent to patients instead of insurance.

Providers usually get most insurance payments, but patient payments often fall behind.

Several reasons lead to this problem:

- Patient Awareness and Understanding: Many patients find insurance words hard and bills confusing.

About 53% say they feel stressed trying to understand what insurance covers and what they owe.

This confusion can cause late payments or upset feelings. - Delayed Payments: Research shows payment chances drop a lot after the patient leaves the clinic.

For example, chances to collect money fall by 62% once a patient leaves the office or hospital.

Small bills (under $35) are more likely to be paid, but bills over $200 have very low payment rates—only about 6% get paid. - Uncollected Balances: Big bills over $200 make up almost three-quarters of all unpaid patient money but are paid at very low rates.

This shows how hard it is to get money from patients who owe large amounts. - Financial Barriers: Nearly 20% of Americans have medical debt sent to collections, adding up to about $140 billion across the country.

Many patients are not ready for these costs.

About 53% of people with high deductibles have less saved than their deductible amount. - Staff Burden and Administrative Strain: Office workers and billing staff have extra stress managing patient collections.

They often lack proper tools.

This raises their workload, causes mistakes, and slows work.

These problems lead to losing more money.

Impact of Rising Deductibles on Patient Experience and Revenue

When patients have to pay more, it changes their experience and the money health providers make.

- Delayed Care and Avoidance: Higher costs make patients wait or skip care.

This hurts their health and lowers provider quality scores. - Decreased Patient Satisfaction: A 2021 study found nearly 40% of patients unhappy with billing.

Also, 63% would think about changing providers for better billing.

And 93% say billing matters in deciding to return to the same provider. - Revenue Disruption During Deductible Season: Deductible season runs from January 1 to about May.

This is when patients use up their yearly deductibles and start paying more out-of-pocket.

Costs go up then, which delays payments and adds work for finance teams.

The average day patients meet their deductible has moved later, now around May 19.

This makes the time patients pay more longer. - Increased Bad Debt and Costs: With poor collection and delayed payments, providers face more bad debt, less cash flow, and higher costs for follow-ups.

Best Practices and Strategies to Improve Patient Collections

Providers must change how they collect money.

Here are some ways that help collect more, reduce bad debt, and keep patients satisfied:

- Verify Insurance and Deductible Status Early

Check insurance benefits, limits, and deductibles before appointments.

This helps set clear money expectations.

Using technology to check this early prevents surprises and prepares staff and patients for payments. - Communicate Cost Transparency Clearly

Providers should give accurate cost estimates before care.

This is required by laws like the No Surprises Act.

Clear costs build trust and encourage on-time payment. - Collect Payments at Point of Service

Money is more likely to be paid at care time.

Practices should collect deductibles and copays upfront when possible.

This can raise collections by 40% or more. - Offer Flexible Payment Plans

Payment plans that fit patients help them pay on time.

These let patients spread out costs without needing credit cards.

This also helps keep patient loyalty. - Use Flexible Payment Methods

Offer many payment options like online portals, mobile pay, text-to-pay, or card-on-file.

Almost 70% of patients prefer online payments because they are easy. - Train Staff in Patient Communication

Teach front-office staff to talk about money clearly and kindly.

Good talking can increase payment collections while keeping good patient relations. - Leverage Analytics and Propensity-to-Pay Models

Use data to find out who can pay and how much.

This targeted effort makes collections better. - Outsource Complex Revenue Cycle Tasks

Give hard billing work to outside experts.

They bring better technology and skills.

This helps offices collect better without adding staff.

The Role of Artificial Intelligence and Workflow Automations in Patient Collections

AI and automation are changing how providers collect money and manage payments.

Automated Patient Financial Engagement

Tools like payment portals, electronic statements, phone systems, and text reminders make it easier to communicate and pay.

Providers using these tools see fast improvements.

Research shows these tools improve patient experience and collections.

Real-Time Insurance Eligibility and Payment Verification

AI systems check insurance and financial responsibility right before appointments.

This makes payments clear and cuts down on claim denials, which happen about 15% of the time.

This helps providers ask for the correct payment at the right time.

AI-Driven Payment Collection Agents

AI can handle routine billing questions, payment reminders, and follow-ups 24/7.

This lightens staff workloads.

Platforms like Simbo AI give phone answering and payment collection services automatically.

This helps keep communication steady without burdening staff.

Predictive Analytics

AI looks at past payment data and patient money info to guess who might not pay.

This helps providers focus efforts where it matters most.

These models guide payment plans and bills.

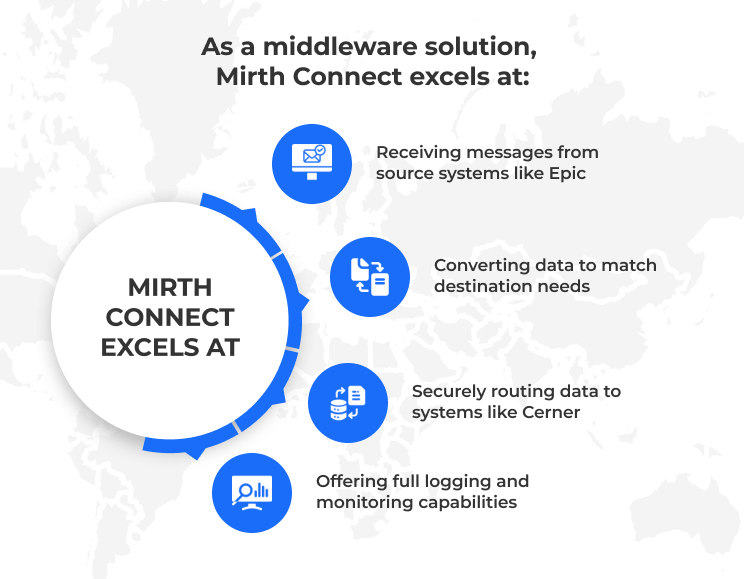

Integration with Electronic Health Records and Billing Systems

Automation links patient bills, insurance info, and payment history inside office systems.

This allows early action, better scheduling, and clear view of balances.

It helps raise collection rates.

Reduction of Administrative Workload

AI-based RCM tools cut time spent on patient support by up to 80%.

This lets staff spend more time on patient care and business priorities instead of chasing payments.

Specific Considerations for US Medical Practices

Medical staff in the U.S. face a complex payment system with many rules and changes. Here are some points to consider:

- Compliance with CMS Price Transparency and No Surprises Act

Only about 16% of hospitals fully follow CMS price transparency rules.

This misses chances to build patient trust and get payments faster.

Practices must also give cost estimates to avoid penalties. - Navigating Deductible Season

The long deductible season needs careful planning.

Practices should check payments early and talk to patients at the start of the year to keep money steady. - Managing Increased Patient Financial Responsibility

With more people having high-deductible plans, providers need flexible policies and trained staff.

This helps reduce patient stress over payments.

It also affects practice income and patient loyalty. - Leveraging AI Solutions Like Simbo AI

AI tools like phone automation and billing agents from companies such as Simbo AI help U.S. practices automate front-office work.

This improves collections and patient contact without more staff. - Integration and Security

Following security rules like PCI standards for card-on-file is very important.

This keeps patient data safe while improving collection efficiency.

The current situation asks U.S. healthcare providers to rethink how they collect money and work with patients on finances.

Rising deductibles and patient responsibility cause problems but also chances to improve transparency, communication, and use new technology.

By using good methods and AI-based automation, medical practices can make patients happier, lower bad debt, and strengthen their finances in a complex healthcare system.

Frequently Asked Questions

What is the current role of patients in hospital revenue?

Patients now account for up to 35% of a provider’s revenue stream, making them the third largest payer after Medicare and Medicaid.

Why are patient collections a challenge for hospitals?

Patient collections are challenging due to rising deductibles and increased financial responsibility, leading to patients often deferring care because of costs.

What percentage of Americans have medical debt in collections?

Nearly one in five individuals in the U.S. has medical debt in collections, totaling approximately $140 billion.

How does the outdated revenue cycle affect hospitals?

The revenue cycle was designed primarily around payer reimbursement, making collections from patients an afterthought, which results in inefficiencies.

Why is patient financial engagement technology important?

PFE technology improves the patient financial experience, offering tools like patient payment portals and interactive voice responses that lead to a better collection process.

What is the state of hospital price transparency?

Despite the CMS hospital price transparency rule, only about 16% of hospitals are fully compliant, with many having missing or incomplete pricing data.

What financial counseling options should hospitals offer?

Hospitals should provide financial counseling that helps patients understand their options, including financial assistance, and assist them with navigating applications for help.

How can patient-friendly payment plans help?

Offering flexible payment plans helps patients avoid high-interest credit card debt and can lead to lower unpaid balances and increased patient loyalty.

What are the benefits of outsourcing patient financial processes?

Outsourcing can relieve stress on hospital staff, provide access to a larger pool of experts, and utilize advanced technologies without substantial IT investments.

Why must hospitals reinvent their revenue cycle?

With patients responsible for a significant portion of revenue, adapting revenue cycle processes to fit this new reality is essential to ensure financial sustainability.

The post The Challenges of Patient Collections in the Era of Rising Deductibles and Financial Responsibility first appeared on Simbo AI – Blogs.