This article is a part of your HHCN+ Membership

Medicaid uncertainty was one of the top concerns I repeatedly heard home-based providers discuss this year. When the One Big Beautiful Bill Act (OBBBA) was passed, it finalized significant Medicaid cuts and seemed to confirm providers’ fears.

Namely, that states would constrict their home- and community-based services (HCBS) budgets due to fewer dollars in their overall Medicaid budgets.

Despite this dramatic change to Medicaid financing, not all home-based care providers accepting Medicaid are pessimistic. In fact, on the most recent episode of HHCN+ TALKS, Aveanna Healthcare’s (Nasdaq: AVAH) CEO Jeff Shaner expressed a particularly sunny outlook.

“I don’t think it’s ever been a better time to be in home and community-based services,” Shaner said. “People say, you’re crazy, OBBBA has changed that. I don’t think it has.”

While I have generally heard more confidence from home-based care providers accepting Medicaid than those accepting Medicare, because the threats to Medicare were so monumental, though the final rule was less severe than feared, I was still surprised to hear a description as upbeat as Shaner’s.

In addition to sharing his bright-eyed view, the leader shared his techniques for providers operating in the Medicaid environment, and I’ll highlight the ones that providers should keep top of mind as they move into the new year.

In this week’s exclusive, members-only HHCN+ Update, I’ll share my key takeaways from my conversation with Shaner, including:

– The reasons for his optimism

– Shaner’s techniques for executing an effective Medicaid strategy

– Why playing the long game is essential

Digging into the good vibes

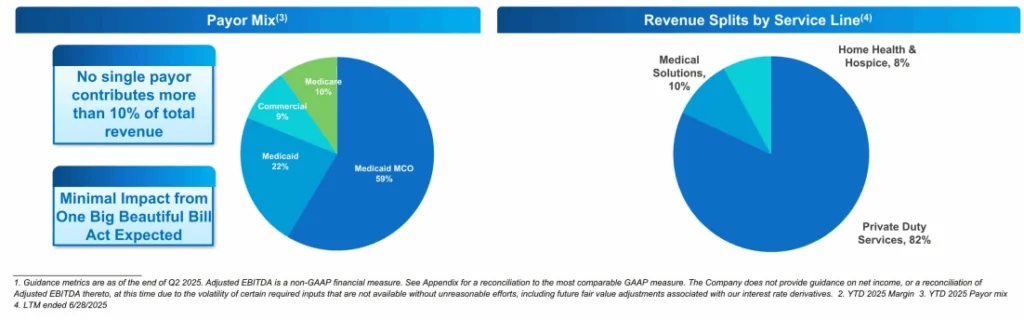

Private duty services represent the bulk of Aveanna’s business, with Medicaid and Medicaid MCOs (Managed Care Organizations) being the organization’s primary payer sources, according to a form 8-K filed at the end of September.

The company at that time expected “minimal” impact from OBBBA, but Shaner took that optimism further in TALKS.

“I think that the pressure on our federal and state governments to do more with less is going to continue to push institutional care, higher-cost care settings into home care,” he said. “That’s us. That’s what we do every day. It’s what our industry does. Being prepared to execute on that strategy, I think, for our entire industry, not just Aveanna, is really important.”

This makes sense. As states must do more with less, home-based care providers stand ready to provide quality care while avoiding the highest-cost aspects of facility-based care.

Still, the Congressional Budget Office (CBO) estimated that the OBBBA would “reduce federal Medicaid spending over a decade by an estimated $911 billion and increase the number of uninsured people by 10 million,” according to KFF.

To my mind, the trickle-down impacts of those figures seem unavoidable. Not so for Aveanna.

“There were no specific changes to the Medicaid waiver programs that a majority of Aveanna’s patient population qualifies for services under, and no provisions that Aveanna believes directly impact its reimbursement rates,” the company’s 8-K read.

Certain waivers covering some in-home services were indeed dinged by the Centers for Medicare & Medicaid Services (CMS) this year, but clearly not the ones most essential to providers like Aveanna.

Additionally, Aveanna has identified a significant market opportunity. In the same 8-K, the company reported a Total Addressable Market (TAM) of $119 billion. Of this TAM, private duty nursing made up $10 billion. Only a fraction of children and adults currently receive necessary private duty services, according to the document, and the home is the most cost-efficient and patient-preferred setting.

PDS, the core of Aveanna’s business, is particularly great because it’s a protected class of patients and the cost of facility-based and home-based care is drastic, Shaner said.

So Medicaid budget changes (while keeping millions of people from health insurance) are not as impactful as many anticipated, and if Shaner is right, will drive states’ creativity to provide access to high-quality, cost-effective care. And therefore, states are likely to drive more people directly into the arms of home-based care providers.

Still, some states have not increased budgets for these services.

“The areas where we’ve seen some temporary rate decreases, I think we called out North Carolina and Colorado, those were necessary to balance … the Medicaid budget within the year,” he said. “In both cases, they gave a rate increase and then had to temporarily freeze it and take it back. Again, it shows maybe each state’s still trying to digest how to swallow this.”

In the bigger picture, states see the need for PDS to maintain their budgets.

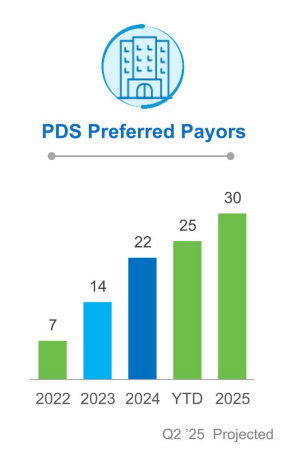

Aveanna is putting its money where its mouth is when it comes to PDS bullishness. The company acquired Thrive Skilled Pediatric Care in April for $75 million and is seeking out more Thrive-like deals in 2026. In fact, Aveanna is currently taking action on a “robust” pipeline of potential acquisitions and plans to start its 2026 M&A strategy off with a bang.

Candor and playing the long game

Shaner and Aveanna recognize that the HCBS orchard is heavy with opportunity, and the organization is prepared with a strategy to maximize its harvest. That strategy centers on engaging payers and lawmakers.

“I would encourage people, if you’re not leaning into payers, if you’re not partnering with government, whether on the state or the federal basis, you need to,” Shaner said. “We have found, as you talk to governors or Medicaid directors, they’re incredibly open. … We find that to be very helpful, that our governors and their staffs and their chief of staffs and the Medicaid directors will tell you, this is the problem we’re trying to solve. How could you help it?”

To execute this strategy, Aveanna moved from playing poker to laying its cards on the table. For Shaner, gone are the days when providers might hold key details like wage data tight to the chest. Now, with an obvious shortage of workers and increasing wage rates, Aveanna has very transparent conversations with stakeholders.

The reason this transparency pays off, he said, is that it shows states that rate increases will directly benefit their constituents. If providers show that $2.75, or $3.25, of a $4 rate increase goes directly to home care workers, they can demonstrate that overhead increases are relatively low, and voters will receive most of the benefit (and pay more in taxes, to boot).

Finding the data to have these conversations isn’t always easy, but finding some indicator of reducing total cost of care and hospital admissions is key, according to Shaner.

I imagine some of this is harder for smaller providers than large, publicly traded companies like Aveanna that have 30 preferred payer agreements in its private duty nursing services. I’d love to hear from smaller providers about their experiences working with state governments – is it the same level of openness and respect for transparency? Perhaps so, but I have my doubts.

Even for well-resourced Aveanna, sometimes the benefits of this strategy don’t come quickly. For most states, achieving a rate increase typically takes between one and two years. Sometimes, it takes much longer. In California, the company has not seen a rate increase in seven years and Shaner anticipates that achieving a rate increase will have taken the company almost five years. Despite the sluggish progress, Shaner said Aveanna will not leave the state.

“We’ve learned over time, don’t leave a state because the rate doesn’t work,” he said. “Time will fix this. Time and energy and effort fixes it. In most states, that’s played true to us. We believe deeply in these families, as I know our peers do too. We’re not going to abandon them.”

For Aveanna, at least, all signs point to its HCBS strategy yielding real dividends – better rates, deeper partnerships and a flurry of new deals as the new year gets underway.

The post Inside The HCBS Opportunity Boom: Why Aveanna’s CEO Is Doubling Down appeared first on Home Health Care News.