Major health insurers have increasingly integrated care provider entities into their portfolios, including home-based care offerings – and are using their provider arms to inflate care prices and evade federal regulations.

Payviders, which include the likes of UnitedHealth Group (NYSE: UNH), Elevance Health (NYSE: ELV) and CVS Health (NYSE: CVS), often utilize a loophole that allows them to mask price increases and avoid paying potentially costly rebates to consumers, according to an article published in Health Affairs.

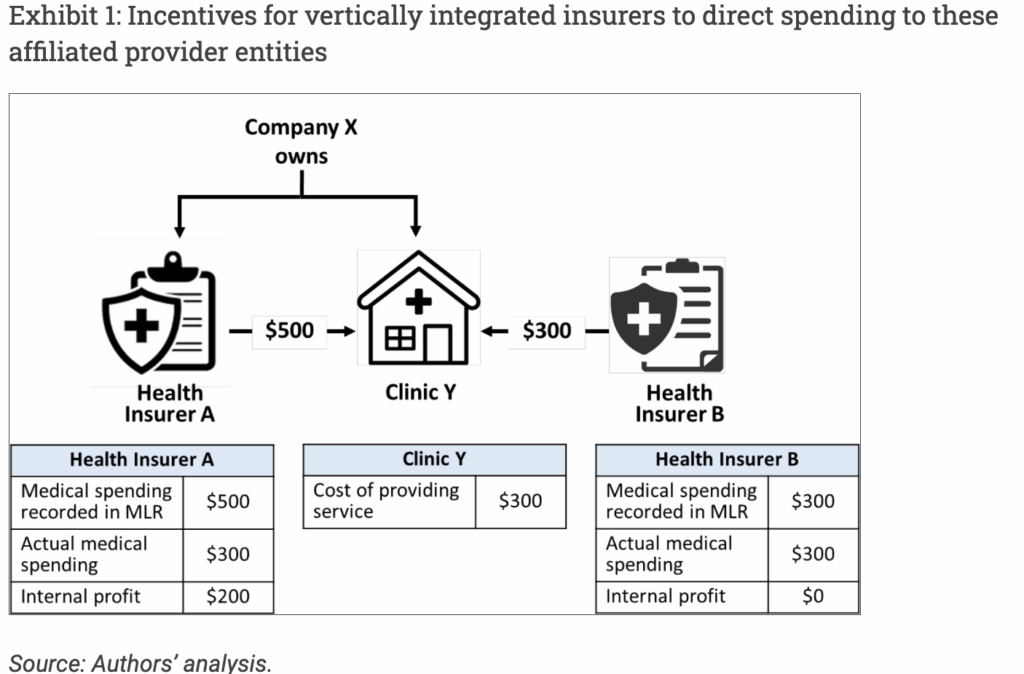

Medical loss ratio measures the percentage of premium dollars that a health insurer spends on medical care and quality improvement initiatives, as opposed to overhead costs or profit. The Affordable Care Act requires insurers to maintain an MLR of at least 80% in small group and individual markets, and 85% in the large group markets – meaning 80 to 85 cents of every dollar must be spent on care and improvement. If not, insurers are required to pay a rebate to consumers.

Since these minimum requirements took effect in 2012, approximately $13 billion has been issued in rebates. The article’s authors said this highlights insurers’ incentives to minimize such payouts.

These rebates incentivize payviders to funnel spending to their affiliated provider practices, which can charge inflated prices, thereby allowing the insurer to increase its reported MLR without actually spending more on care or quality improvements.

“This dynamic reveals a limitation of the MLR rules,” the article’s authors wrote. “When the insurer is also the provider, there is less transparency into how health care dollars are actually allocated. The vertically integrated insurer and provider entity can also artificially inflate prices for medical services, worsening the nation’s health care affordability problem.”

Payviders’ strategies have also led to a rise in Medicare Advantage non-claims payments, the authors wrote. For example, the state of Oregon has reported that its rise in non-claims payments were largely due to UnitedHealthcare shifting a significant share of its claims payments into non-claims spending through Optum.

“These trends are not limited to Medicare Advantage, however,” the authors wrote. “UnitedHealth and other major insurers such as Elevance and Aetna operate across multiple markets, raising concerns about similar dynamics in the commercial market.”

To avoid the negative impacts of these strategies, the article’s authors recommend stronger oversight – which has also been recommended by lawmakers.

Senators Elizabeth Warren (D-MA) and Mike Braun (R-IN) urged the Department of Health and Human Services (HHS) Office of Inspector General (OIG) in 2023 to evaluate the extent to which vertical integration has increased costs and allowed insurers to bypass MLR requirements. Other lawmakers have made similar requests regarding Medicare Advantage.

Policy makers should assess whether regulatory tools like the MLR are adequate, the authors recommended, and that states must apply greater scrutiny of vertical integration arrangements, the authors wrote.

“Addressing these issues will be essential for maintaining the integrity of cost containment efforts and ensuring that health care dollars are spent on delivering meaningful care,” they wrote.

The post Payviders Exploit Loophole In Medical Loss Ratio, Driving Hidden Medicare Advantage Cost Growth appeared first on Home Health Care News.