In a year of uncertainty surrounding Medicaid, Aveanna Healthcare Holdings Inc. (Nasdaq: AVAH) has reached what CEO Jeff Shaner refers to as “rate clarity.”

Specifically, Aveanna achieved 11 state rate increases and two federal rate wins in 2025.

Shaner explained the company has been largely insulated from changes to Medicaid because of the population it serves.

“Seventy-eight percent of our revenues are in our private duty services (PDS) segment,” he said at the Jefferies Global Healthcare Conference on Tuesday. “That segment is primarily our pediatric private duty segment. It is, by far, the largest business segment within PDS. It’s a relatively protected class. Think of this group as incredibly fragile [children], most likely born with some kind of comorbidity … When you think of that population, nobody in government is trying to take money from that population.”

Federal and state-level agencies, managed care organizations and commercial payers are all interested in investing in pediatric private duty care, Shaner said.

Atlanta-based Aveanna Healthcare offers a range of pediatric and adult health care services, including nursing, rehabilitation, occupational nursing in schools, therapy services, day treatment centers for medically fragile and chronically ill children and adults and home health and hospice services. The company has 327 locations across 34 states.

Serving medically fragile pediatric patients yields significant cost savings, Shaner said.

“[Our PDS business], is functionally an ICU bed at home,” he said. “The macro difference in a health acute care setting is about $6,000 a day for our pediatric patients, and at home is about $600 a day with pediatric nursing, so 10x savings.”

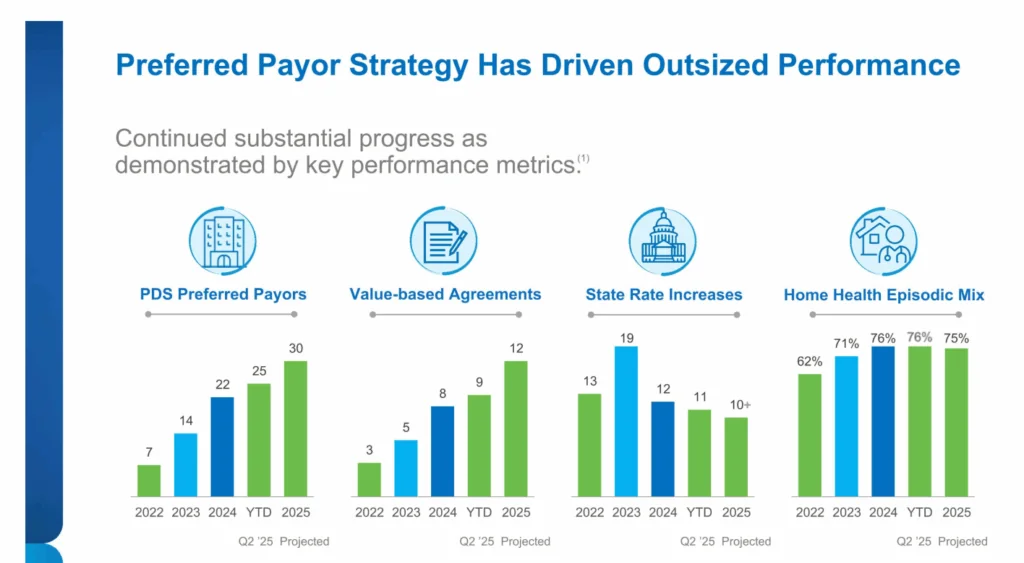

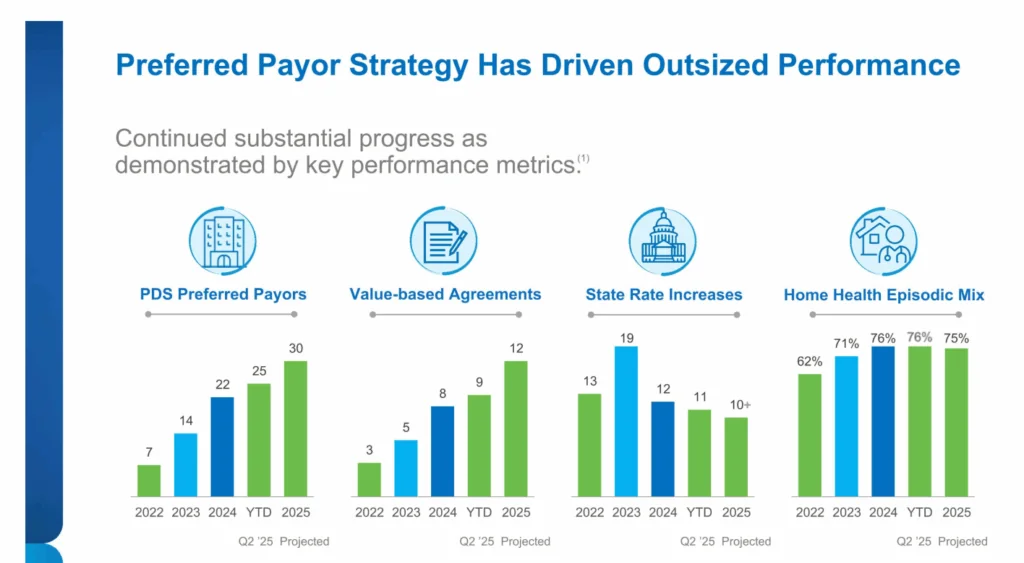

Aveanna also continues to see traction by leaning into its long-term preferred payer strategy. This approach has allowed the company to navigate resource scarcity, especially in terms of staffing.

“Our preferred payer strategy, fundamentally, is leaning in and partnering with payers who will partner with us, by allocating our capacity to those payers who value us,” Shaner said. “When I say value, I mean pay us at an above market rate, and are willing to engage with us on value-based bonuses or metrics. We’re able to meaningfully move the needle for those payers.”

Currently, Aveanna has 25 preferred payers in its PDS segment, with 55% of the segment’s available volumes now having a preferred payer. The company’s leaders believe this will continue to grow, reaching 75% to 80% in the next few years.

Establishing transparency with its preferred payer partners has also benefited Aveanna when it comes to staff wages, according to Shaner.

“It’s refreshing to be transparent with your payer partners,” he said. “For so many years, you kept everything behind a veil of secrecy. When you tell them the truth, you tell them exactly what it takes to hire a nurse in that market, they get it. They understand, ‘Okay, the majority of what I’m giving you is going right to wages.’ As long as you continue to take on more capacity, it’s a win-win.”

The company saw 6.9% year-over-year growth in PDS volume in Q2.

“We’re going to continue a hyper-growth model in the back half of this year and into 2026,” Matt Buckhalter, CFO and principal financial officer at Aveanna said.

The post Aveanna Achieves ‘Rate Clarity,’ Seeks Hyper-Growth Amid Medicaid Uncertainty appeared first on Home Health Care News.